Source: Techmoran

The Nigerian payment service provider, Paystack, is now available to all businesses in Kenya after launching in private beta 10 months ago.

The firm anticipates this will bring its payments and business growth tools to even more ambitious businesses across Africa.

Paystack, with operations in Ghana, Nigeria, Kenya, and South Africa, launched in private beta 10 months ago after it had received a Payment Service Provider Authorisation from the Central Bank of Kenya, the country’s remittance, banking and payments regulator.

Launched in 2015 by Shola Akinlade and Ezra Olubi, the YCombinator-backed firm expanded to Ghana in 2018 and to South Africa in 2021. Paystack was acquired by Stripe in October 2020 for $200 million after raising a total of about $12 million.

Now boasting of over 200,000 businesses — from startups, and e-commerce stores to household names, such as MTN and UPS — that accept payments using Paystack, Paystack powers growth for organizations of all types and sizes, from startups to small retailers, to government agencies, and enterprises.

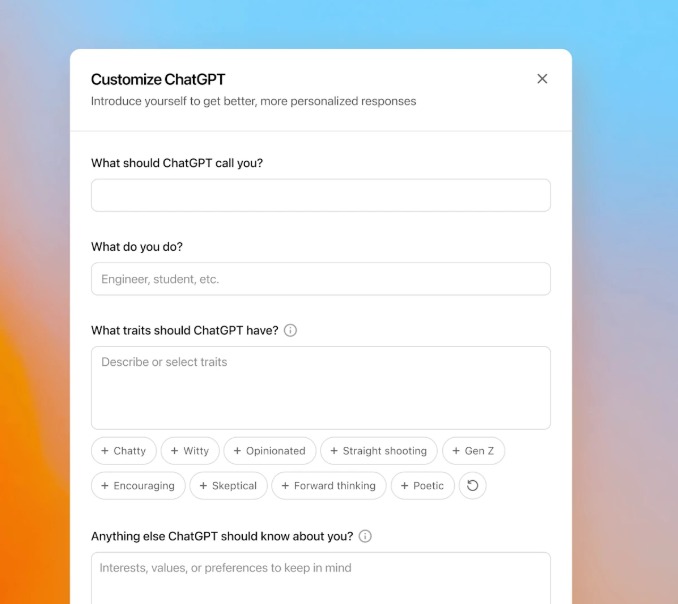

All businesses in Kenya now have access to the following Paystack tools to accept payments online via multiple channels: Cards (Visa, Mastercard, American Express), M-PESA, and Apple Pay and get settled in KES and USD, into your preferred bank account or M-PESA wallet.

Paystack’s Split Payment feature also lets users take one customer payment, and create rules that automatically split that payment into multiple bank accounts or M-PESA wallets and accept payments through several e-commerce platforms such as Shopify, WooCommerce, Zoho, Wix, and transfer money easily to M-PESA wallets as salaries, savings and vendor payments.

Users can also use the platform to collect recurring payments automatically and manage subscriptions, manage transaction disputes such as refunds and chargebacks from the Paystack Dashboard, monitor business’ performance in real-time with the Paystack Dashboard and Mobile App valuable for accounting, reconciliation, and audits.

Paystack also allows one to define custom user permissions to give different members of your team access to specific parts of your transaction information and comes with automated fraud detection and features such as Two Factor Authentication (2FA) and IP whitelisting which help keep businesses and customers safe.

Source: Techmoran