Source: Temitope Akintade/Technext

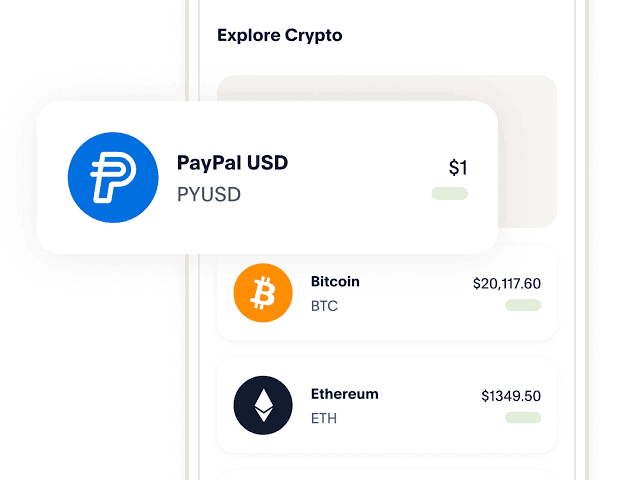

On Monday, payments giant, PayPal made an announcement that signals its entry into the world of blockchain with the launch of PayPal USD. According to the release, the stablecoin will be issued by Paxos Trust Co., backed by United States dollar deposits and short-term US Treasuries.

Dan Schulman, president, and CEO, in a press statement, said:

“The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar. Our commitment to responsible innovation and compliance, and our track record delivering new experiences to our customers, provides the foundation necessary to contribute to the growth of digital payments through PayPal USD.”

The company said the stablecoin will be available to an “already large and growing community of external developers, wallets and web3 applications,” and can be easily adopted by crypto exchanges. PYUSD will first be available on popular payments app Venmo and to customers in the United States.

Additionally, the payments company said it would provide attested reports of the funds backing the stablecoin, in an effort to thwart concerns about unbacked tokens. In the press release:

“Beginning in September 2023, Paxos will publish a public monthly Reserve Report for PayPal USD that outlines the instruments composing the reserves. Paxos will also publish a public third-party attestation of the value of PayPal USD reserve assets.”

Adding:

“The attestation will be issued by an independent third-party accounting firm and conducted in accordance with attestation standards established by the American Institute of Certified Public Accountants (AICPA).”

This strategic move by the company is expected to revolutionize the financial landscape and provide a substantial boost to the adoption of digital tokens for payments.

Benefits the PayPal stablecoin can offer

Stablecoins combine the benefits of blockchain technology with the stability of traditional currency, effectively bridging the gap between conventional financial systems and the digital realm.

With this move that intends on utilizing the blockchain, the company aims to offer its users fast, secure, and low-cost cross-border transactions, reducing friction and expanding its global reach.

Additionally, the sluggish adoption of digital tokens for payments has been a persistent challenge. But now, PayPal’s entry into the stablecoin arena could act as a catalyst for change. As a trusted and widely recognised financial entity, PayPal’s endorsement of stablecoins could potentially encourage mainstream adoption. This not only benefits PayPal but also has broader implications for the broader blockchain ecosystem.

Furthermore, PayPal’s move into the stablecoin market differentiates it from competitors in the financial industry. By offering a stablecoin, PayPal distinguishes itself as an innovator in a sector traditionally dominated by legacy financial institutions. This differentiation can help the company attract new customers, retain existing ones, and secure its position as a leader in the digital payments space.

While the introduction of $PYUSD presents numerous benefits, it also comes with potential regulatory challenges. The stablecoin landscape is subject to evolving regulations, and PayPal must navigate this complex regulatory environment to ensure compliance.

Binance, Tether and Circle are prominent examples of stablecoin companies that have encountered issues with regulators globally. However, by proactively working with regulators and demonstrating a commitment to transparency, PayPal can mitigate potential obstacles and build a sustainable stablecoin ecosystem.

Source: Temitope Akintade/Technext