Mastercard and Awash Bank have announced a new international prepaid card and Payment Gateway Service to improve Ethiopia’s card industry, enabling online payments for customers and merchants worldwide while expanding the bank’s service offerings.

Stay well-informed and be the very first to receive all the most recent updates directly in your email! Tap here to join now for free!

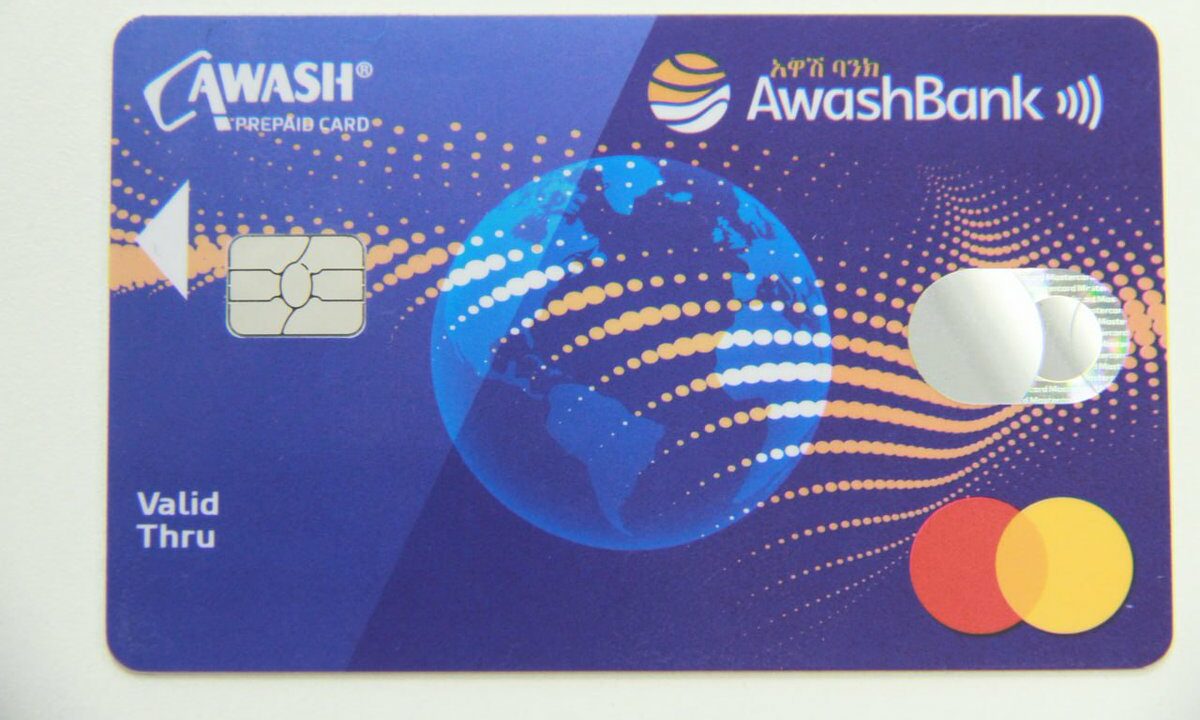

The plastic card allows cash withdrawals from ATMs, payments at point-of-sale terminals, and online shopping at merchants accepting Mastercard globally. The virtual card enables online purchases from any global merchant website.

Customers can conveniently add funds to the Awash Mastercard at Forex bureaus, making it suitable for international payments and travel expenses. The inclusion of Mastercard’s Payment Gateway Services (MPGS) will enhance Awash Bank’s service offerings.

Mastercard’s Payment Gateway allows local merchants to integrate and accept international online payments, enabling customers worldwide to place orders, reservations, and payments with merchants using MPGS.

Shehryar Ali, Senior Vice President and Country Manager for East Africa and the Indian Ocean Islands at Mastercard, sees the partnership as part of the company’s dedication to enhancing financial inclusion in Africa.

The new payment digitization aligns with Ethiopia’s National Digital Payments Strategy (NDPS) 2021-2024, aiming to enhance service delivery efficiency, promote transparency, support women’s economic participation, foster financial inclusion, and sustain inclusive growth. Customers can now conduct contact or contactless transactions at ATMs and PoS using a plastic card.

Stay well-informed and be the very first to receive all the most recent updates directly in your email! Tap here to join now for free!